In addition PRS funds are also allowed to invest in exchange-traded-funds based on physical gold to increase asset diversification into alternative investments the commission. The answer is no.

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

The table below is updated monthly to give you a snapshot of PRS fund performances over a five-year and 1-year period.

. And as of recent years the govt is said to have spent almost RM28 billion for these purposes. Additionally the Malaysian Governments Budget 2012 specifies a tax relief of up to RM3000 for 10 years beginning 2012 for contributions to the PRS. G21 G23 K3 1.

Past performance is no guarantee of future returns so use it only as a guide to your retirement planning needs. And the money the govt is using actually comes from the rakyats money. Literature Review Malaysia applies the World Bank five-pillar pension scheme which are.

Its a voluntary long-term savings and retirement scheme available to employed or self-employed to supplement your retirement savings. Postal Address Private Pension Administrator Malaysia 3 Persiaran Bukit Kiara Bukit Kiara 50490 Kuala Lumpur Fax 03 6204 8995 Website wwwppamy. Permanent departure from Malaysia.

The Morningstar Categories for funds in the Malaysia Private Retirement Scheme universe were first established shortly after the establishment of the initiative by the Malaysian Government to help investors make meaningful comparisons between Investment funds. If you have two PRS accounts with RM500 invested in. Private Retirement Scheme Planning.

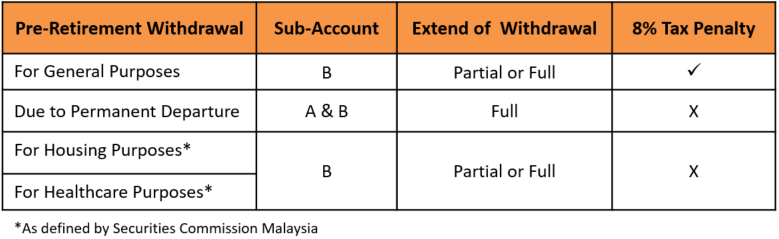

At a rate of 3 interest pa it should give you returns of RM 656603. You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4. Now just imagine this in 2017 itself the govt set aside RM3 for civil servants salaries and pensions for every RM10 it spent.

Introduced by the government to help encourage long-term retirement savings PRS is meant to. Private Retirement Scheme Legal Framework Investment Law Islamic Private Retirement Scheme JEL Classifications. To ensure private sector employee and self-employed to have sufficient savings upon retirement.

For a complete view of all PRS Funds Performance please click here. KUALA LUMPUR Feb 21. Cost of govt pensions over the years.

Morningstar Analysts 28022014. We spoke to Ismitz Matthew De Alwis of Kenanga Investors Berhad KIB to share a little insight on this scheme. The revised Guidelines on PRS will take effect on the issuance date.

Private Retirement Scheme PRS - FAQs Page 4 Although lump sum withdrawals are permitted members are encouraged to retain their savings for. INTRODUCTION The introduction of the private retirement scheme PRS by the Malaysia Government in 2012 was a result of recommendations made by the Securities Commission Malaysia SC to hasten. Economy Employment Finance Investment Tax.

For the list of PRS Funds and their fees. Government has made a move to introduce Private Retirement Scheme PRS in late 2012. I The non-contributory zero pillar which is the social support to provide a minimum level of protection.

Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your contribution time horizon risk appetite and age. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. I announced a tax relief up to RM6000 for EPF and life insurance be extended to the Private Pension Fund now known as Private Retirement Scheme.

Having a voluntary scheme in addition to the EPF also allows private company employees and self-employed persons to voluntarily contribute towards their retirement in a systematic way. Compare the 2 actions above. In order to ensure the welfare of retirees upon reaching retirement.

On the other hand if you had invested the amount at an average rate of return of 8 pa you would have gotten returns of RM 1178040. Each PRS offers a choice. You need to be a new member of PRS.

Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. The Securities Commission Malaysia SC announced today that conservative funds under the Private Retirement Scheme can now invest in foreign markets. 4 Choose Performance and extract the YTD return into the Excel sheet.

Housing purposes From sub-account B Healthcare purposes From sub-account B Permanent Total Disablement PTD Serious Disease SD Mental Disability MD From both sub-account A and B 2The age group may. Lets say you invest RM 2000 per month in a fixed deposit account for 20 years. 3 Copy and paste the data into an Excel sheet.

You need to be Malaysian citizen. However to facilitate compliance with paragraphs 1110A 1113 and 1113A PRS Providers will be. Private Retirement Scheme PRS was introduced by the government in July 2012.

This scheme are welcome by many working class and entrepreneur as vehicle to give additional tax relief of RM3000 B or BE 2019 item F16 on top of the existing Insurance and KWSP tax relief. Morningstar regularly reviews the category structure. PRS form an integral feature of the private pension.

In the 2011 Budget. 2 Select Core Conservative under Malaysia PRS Categories dropdown menu and click the Search button. When will the revised Guidelines on Private Retirement Schemes Guidelines on PRS take effect.

You are aged between 20 40 based on your date of birth Accumulated investment with more then RM1000. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. With increasing life expectancy and rising living standards many Malaysians find that their savings are inadequate to meet their retirement needs.

There is none but there are certain criteria that you would need to meet and its as below. Private Retirement Scheme Malaysia. Essay Pages 4 900 words Views.

5 Calculate the 5-Year Annualised Average Return using the geometric average formula.

Private Retirement Scheme In Malaysia Dividend Magic

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Prs Malaysia 2019 Review Should You Really Invest

Which Prs Funds To Invest In 2020 2021 Mypf My

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

A Guide To The Private Retirement Scheme Prs

Prs Malaysia 2019 Review Should You Really Invest

Pdf The Awareness Of Private Retirement Scheme And The Retirement Planning Practices Among Private Sector Employees In Malaysia

Best Private Retirement Schemes Malaysia 2022 Imoney My

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

Prs Malaysia 2019 Review Should You Really Invest

Prs Malaysia 2019 Review Should You Really Invest

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

How To Choose The Best Private Retirement Scheme Malaysia

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Private Retirement Scheme In Malaysia Dividend Magic

Prs Malaysia 2019 Review Should You Really Invest